Get My Weekly Gold & Silver Timing Briefing — For Just $39/Month

Real-time insights, cycle cues, and conviction levels on precious metals & miners — distilled from the same process I share at my $10,000+ private events.

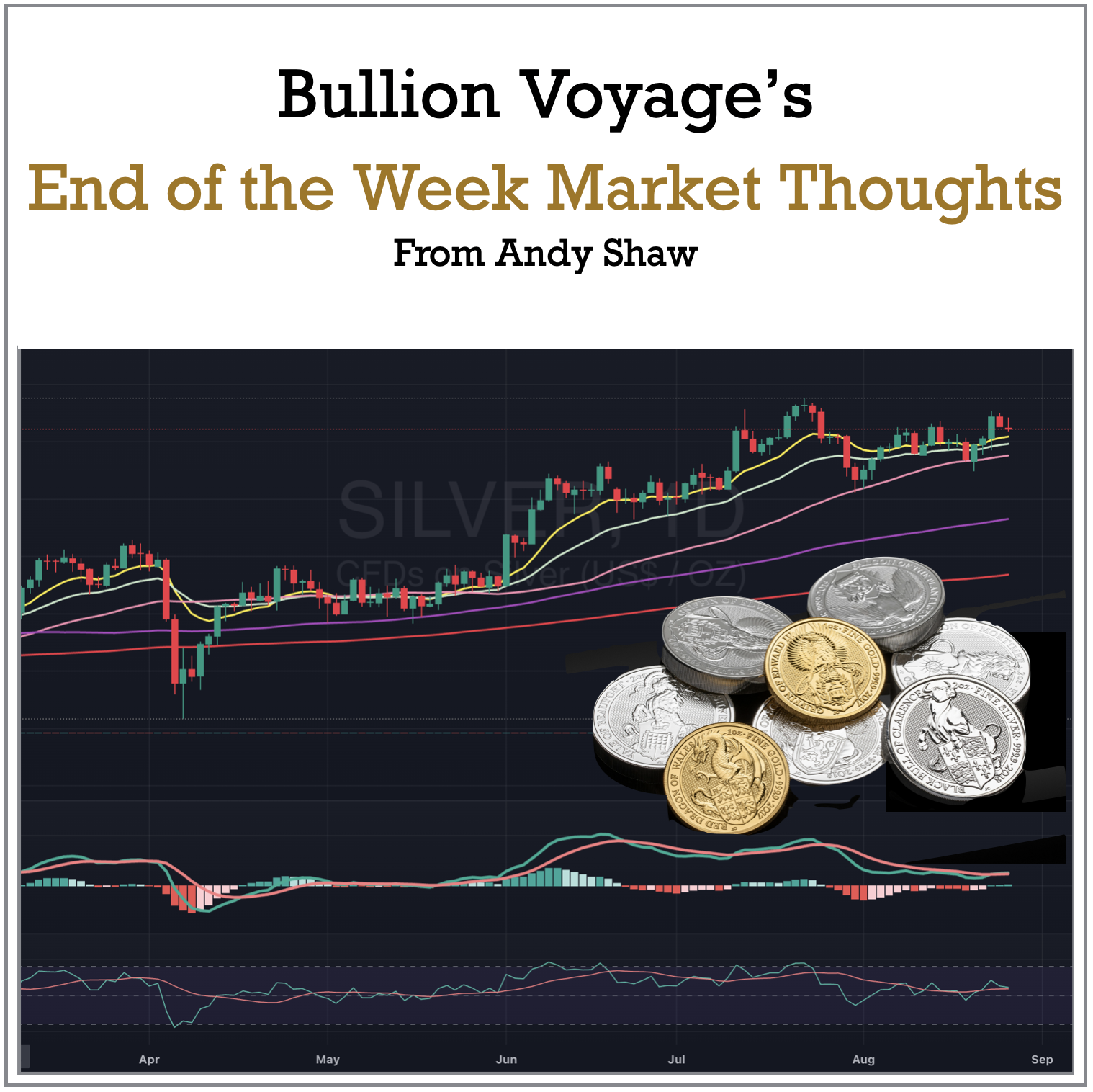

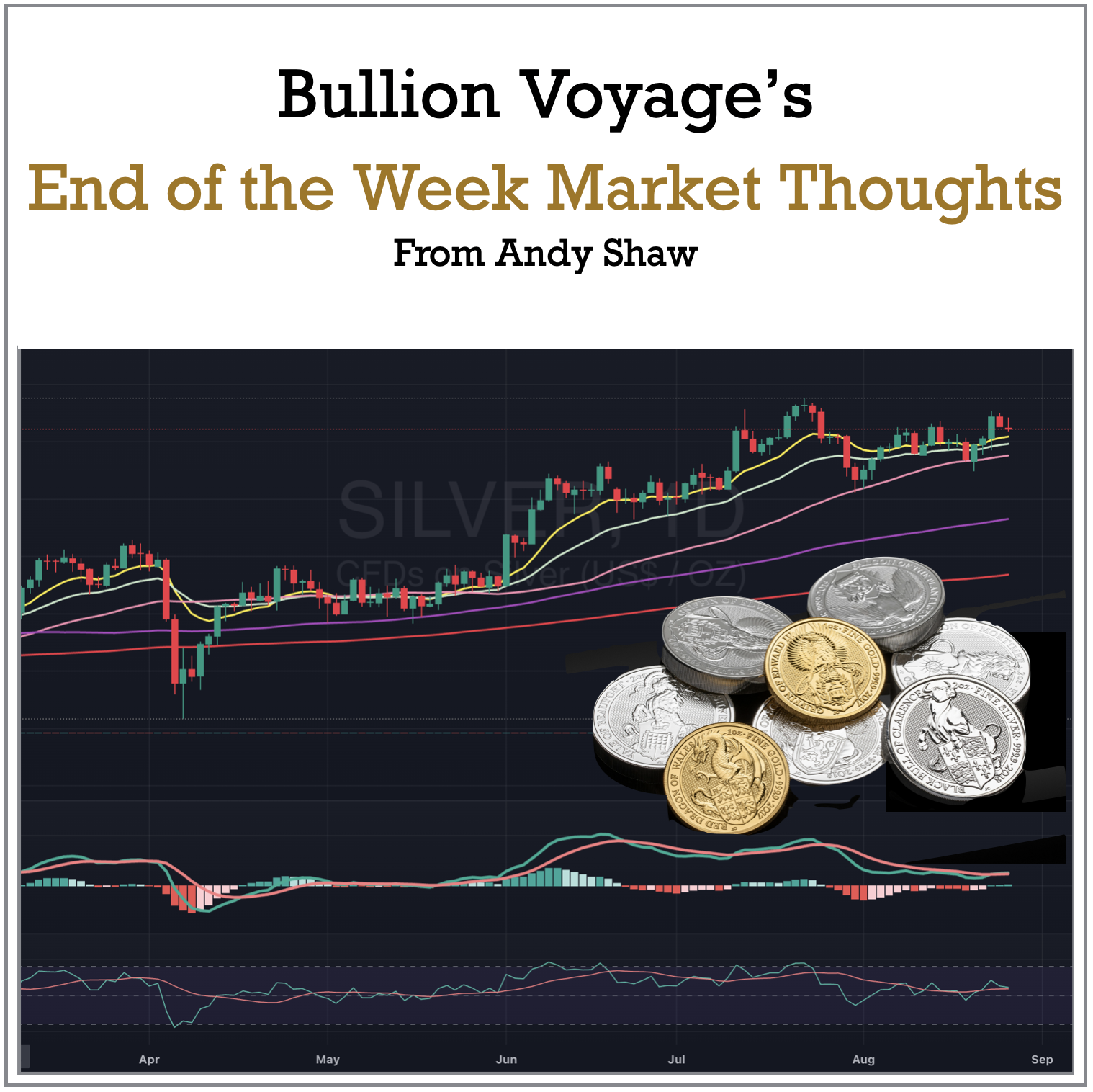

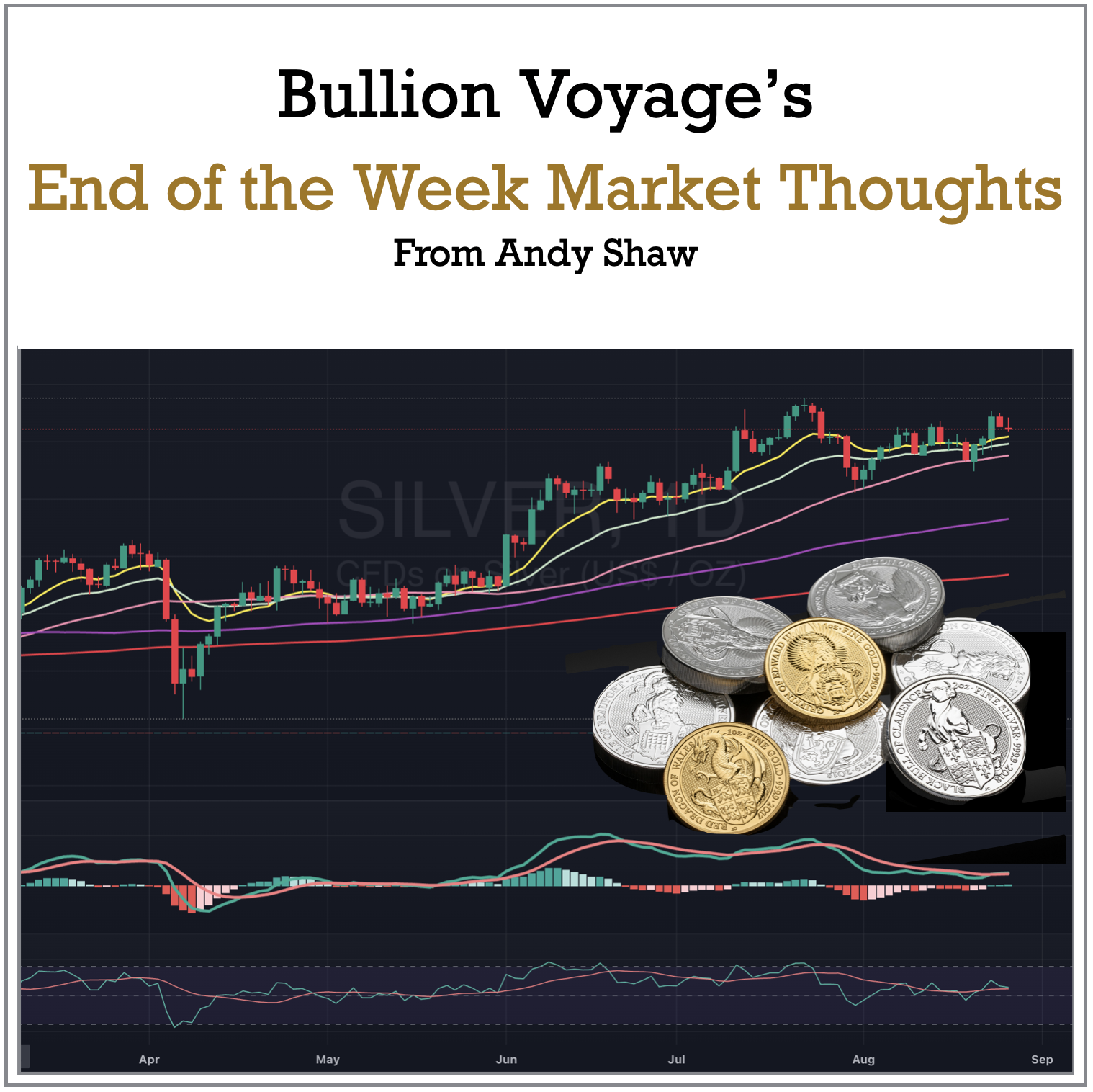

'My End of the Week Market Thoughts'

If you follow gold, silver, and the precious‑metals miners — and you want a disciplined way to time exposure without living on a trading desk — this is for you. My members paid $10,000+ to sit in the room and learn my timing framework. This weekly briefing is the streamlined, affordable way to stay in sync with how I’m reading the market right now.

What You Get Every Week

1) The End of The Week Market Thoughts I am Sending To Mastermind Attendees

As concise a read as possible on what I see as the key macro backdrop influencing gold & silver: rates, USD, liquidity, risk appetite, and the one or two variables that actually matter this week.

2) Timing Triggers I’m Watching

The exact levels, dates, and conditions I’m stalking (trend, momentum, breadth, seasonality windows, volatility regimes) so you know what could unlock the next move.

3) Key Actions

How I’d think about scaling in/out: levels for adds, trims, or standing down; where caution beats courage.

4) Chart Images

When relevant charts with annotated key levels — built for fast decisions.

5) Rate Cut/Rise Expectations

My accuracy on rate cuts/rises is quite simply astonishingly accurate. On the rare occassions I call it wrong (when the FED or BOE didn't do what they should've done), it sets up an even better call for next time.

6) Global Macro Market Analysis

My thoughts on what the results will be from the powers-that-be's strategic manoeuvres. I.e. Where the puck is now going to go...

Why Members Like This

- Clarity over clutter — one playbook, not twenty opinions.

- Time savings — the work is done; you get the conclusion.

- Conviction — it’s easier to act when you know why.

- Risk first — I outline invalidation points before entries.

Entry-Level Plan Built on the Same Framework

This is the lower‑cost companion to my two premium stock‑picking services. You won’t get individual miner picks here (well I might throw in the occassional one) — you’ll get the timing edge that helps you use those ideas better (or avoid them when conditions stink).

Why Timing Matters in Precious Metals

Gold and silver can drift for weeks — and then move fast. Miners can move even faster when margins expand. Knowing when to press and when to wait is the difference between catching the wave and getting tossed by it. My job is to point to where the edge actually is this week.

Some Topics Covered Recently

- The FED pivoting to a dovish stance

- The effects of the Trump/Putin, Trump/Zelensky meetings

- How undervalued the Mining Stocks are compared to how overvalued the stock market is

- Next FED rate decision

- Gold price consolidation

- Silver price expectations

- Economic reality as opposed to mainstream economic thinking

- Which countries economies are in the most amount of trouble

- Relevant stock adjustments

- Some of the unseen consequences of the tariffs

- Safety or lack of it timing wise

Here is an extract from a recent update

End of Week Market Thoughts 9th August 2025

Here is an entire End of the Week Thoughts Article

End of Week Market Thoughts 7th June 2025

As you all should know by now, Silver breaking $35 was the trigger point to the much larger move which now looks to be happening over the summer, and looks to have not been put off to the autumn. Obviously, this is only what it looks like now, and next week it could be all change.

Silver closing the week at 35.967 is a massive deal, and if this were the 30th of June now, then that close would bring in something called macro discretionary funds.

These funds are a type of hedge fund that seeks to profit from large-scale economic and geopolitical trends by making active investment decisions based on human judgment and analysis.

If Silver were to close on 30th June at the price it is today of $35.967, it would be the second highest quarterly close of all time. If it goes up to $37.59, then it would be the highest quarterly close ever. Either of these closes will bring in the big boy money. Which will drive the price up. So, no summer doldrums for Silver if we get either of those closes.

A short bit on the summer doldrums. Vince Lanci did a video this week ridiculing the summer doldrums, and said those of us who say it are wrong. I would bow down to his expertise, except I have experienced it for 4 years now, and vividly experienced it in the last 2 years. So mine may be recency bias, and he should be trusted more imo. So I’m taking back my judgment on that one as new data has come in.

Moving back to Silver. Silver is where Gold was 16 months ago. Gold broke out of its pattern and ran up nearly $1,500, or 75%. I think we have seen the silver low for now on the mid-term, it was $28.33, and that actual low may not be ever hit again if we go on a big enough run, but that’s yet to be seen.

Silver is looking good for next week on the daily, but the 4hr is showing it is going to retrace Monday. My guess (and it is a guess) is that Silver is not done yet, and it will move up next week.

If you look at Gold on the daily, then you will see the 50-day moving average has acted as a support line since October 2023. Gold pierced this MA with a wick on 15th May, and it is only $56 above it now or 1.65%. The weekly MACD looks to be rolling over, and the RSI crossed downwards a few weeks ago, yet the gold price is slightly higher. Which indicates it is tired and wants to go lower.

But that does not mean it will, but pure technical says the odds are for a move down consolidation only though. The long-term uptrend remains EXTREMELY STRONG. That’s in both Gold and Silver. So any down movements I talk about are on the short or short, short timeframe. Mainly, they are not even on the short timeframe. Short, short being the next 5 to 7 days, short being the next 15 to 20 days, we move into the mid’s after that.

So Gold on the short, short, and short appears to be looking to consolidate or move down slightly. But I don’t think it will be much, as there are too many buyers for that. The manipulators may try to slam again to get out of their short positions, but that will be quickly bought up. So if you are holding rather than going in and out, then you have nothing to get concerned about and can enjoy the summer.

But a little deeper on Gold, the daily looks like it has further to go down, but if you look at the 4hr, then that strong swing down appears to be getting close to being done.

So if you are working on maximising your gains, then we have to pay a lot more attention. To me right now, both Gold and Silver look relatively good for Monday, but that may only be in the Asian markets, and then they could enter downswings when the US market opens. If we have some nice, reasonable upswings in the Asian and UK hours, then I will take the opportunity to trim some of my positions out of US hours. If Silver is strong, then I will not be trimming any Silver stocks at that time.

When the US market opens, I am thinking to continue to trim and follow the market, stop trimming if it's bullish, trim a bit harder if it is slightly bearish, and trim hard if it’s very bearish.

This particular move has in the past cost me more than I have made in the act of doing it, and on more occasions than I have made money. However, the last time I did it, a week or so ago, I got it right and was able to buy back most stocks at a lower price. It is not a move for the faint-hearted, though. It also involved me buying back several stocks at a higher price than I got out of.

This is actually a key ego trap to get past.

Our egos want to throw rocks at us here for our poor choice of getting out and not getting back in at the right time. We need to learn to get past our ego here and instead look at the market in the moment we are in.

So when our ego throws up the ‘you dumbass’ line, this becomes the pattern interrupt to in that moment, listen to your intuition and say to yourself, “that was then, this is now, is this a good enough use of my money today?” Then listen for your intuition to guide you.

This is guerrilla warfare against your ego. You are using its strength against it, that’s IF you can master this seemingly tiny, but all-powerful mindset hack.

Now moving to the miners…

If you look at the GDX on the weekly, we have a ‘Gravestone Doji’ candle.

Look at your cheat sheet. What does that indicate?

Clearly, the word gravestone should give it away Sherlock, but it is good to recognise these candles when they are presented to us. Why Nicola, because a pattern is far easier to remember than some phrase like macro discretionary funds, and it aids in better decision making and making more money.

So, look at your cheat sheet. And even though I shouldn’t need to do this as your cheat sheet should be up on a tab all the time, here it is again:

GDX looks even worse on the 1day chart, doji candle on Wednesday, followed by two down days, then MACD rolling over, and RSI turned down. This all says short, short-term correction to me.

So trimming gets stronger. But the way the market moves is when silver goes, it pulls gold up with it. So that characteristic is also in play. We have a lot going on regarding market direction this week!!!

Which means it comes right down to your comfort zone.

Because if you are mainly in, say, 80-90% in, and showing good profits, then your positions are good. But the odds are strongly in favour of short, short-term downside. Will you be able to get out and come back in and not be in a worse position?

I’ve done this maybe 10-15 times now, and I have succeeded with it on 3 occasions that I can remember. So, what is your comfort zone? Giving back profits that YOU WILL later see again, as we are in a long-term uptrend - that’s if you stay in.

Or taking some of the profits you made out to only maybe get back into the position, at all, or potentially at a higher place. Or are you not able to watch the profits leave the building and ignore the potential costs…

Whichever way you choose, the important thing to remember is:

This is a game, the secret is to remain in the game. You are learning to play the game better; you do not need to win every fight to win the game, but to win the game, you need to stay in the game, and the nature of the game is to want to become a better player. So, risks can be taken to become a better player.

So with that in mind, if your solution is to hold, sell, or trim. Then why not do hold, sell, or trim on a percentage basis instead? Say either 20%, as a minimum or 33%, or 50%. That’s what I’ll be doing. All or nothing does not make you a better player; anyone can get lucky and draw the wrong conclusion from their luck.

To finish off, Silver has begun its move, and the next two months look very good, so we are only playing with short, and short, short-term timeframes.

I’ve waffled enough…

Have a good weekend,

Andy

P.S. I start the next event next week, so next weekend my update will probably be one paragraph unless there is something I have to talk about.

END

I send these out weekly, some are longer, some are shorter - dependent on news and the market. When I am travelling, they are more abbreviated

What happens after you join

Adding you to the group is a manual process, so it may take us 24 hours to add you to the system. If you join over the weekend, you will be added on a Monday morning before the market opens.

What You Get Every Week

- Weekly briefing + mid‑week updates when needed

- Timing Triggers I’m Watching

- Key Actions

- Global Macro Market Analysis

- Cancel anytime — no lock‑in

Get My Weekly Gold & Silver Timing Briefing — For Just $39/Month or $299/Year

***You will be added manually, can take up to 24 hours***

***This is a subscription and you can cancel at ANY time***

Frequently Asked Questions

1) Do you send trade alerts?

No. I share timing frameworks, levels, and scenarios so you can make decisions that fit your risk and account.

2) Is this right for beginners?

If you understand basic investing terms and can place a trade, you’ll do fine. I keep the language clear and the action map simple.

3) Will you cover juniors?

I focus the weekly lens on metals, seniors, and mid‑tiers, with context that applies to juniors when liquidity and risk conditions line up.

4) Can I cancel anytime?

Yes. One click inside your member settings, effective immediately.

5) Is there a guarantee?

No performance guarantees ever, no advice ever. I stand behind the quality of analysis. If it’s not valuable, cancel anytime. Also, please feel free to tell others how bad the analysis was.

Important Disclosures

Final Nudge...

Get My Weekly Gold & Silver Timing Briefing — For Just $39/Month or $299/Year

***You will be added manually, can take up to 24 hours***

***This is a subscription and you can cancel at ANY time***

Do my thoughts add any value to your life?

Who am I, and why I may have a unique value to you...

I was fortunate enough to have a wise and rich uncle who, in the early 1980's told me my future. He never gave me any money but he told me I was going to have a fantastic life, make many millions, and that I would help a lot of people.

I went on to build 7 companies in the Home Improvement sector, spanning all areas of the industry in my niche, employing well over 100 people. Then, after 11 years, I realised it would make me wealthy but not rich, so I went and figured out how to make millions in real estate.

I set the ridiculous goal of being a millionaire in two years and achieved it in just over six months, then became a multi-millionaire just a couple of weeks later.

My 'public' career began with teaching people how to make millions in real estate, too. For a while, my work became the best-selling book in the UK on property investment.

In that 2006 book, I predicted that the only way the strategy I created could fail was if all the banks stopped lending money at the same time.

Something which several bank managers I spoke with at the time said was 'unthinkable.'

Then in 2008, the Great Financial Crisis struck, where the 'unthinkable' Black Swan event happened, and all the banks stopped lending money at the same time. I lost in excess of $50,000,000 and went bankrupt in late 2009. I lost the millions, but I retained the mindset required to create many more millions. I was also in the wonderful position of having the opportunity to begin again more intelligently.

After a somewhat strange and very enlightening experience, the story of which I told in my next two books, Creating A Bug Free Mind & Using A Bug Free Mind. Becoming a multi-millionaire again just 3 years later.

I travelled around the world selling them and having some truly amazing experiences, helping people from all walks of life, from royalty to the homeless. I partly retired from this in 2018, then fully retired in 2020.

That year, I saw what was coming in the world regarding precious metals and decided I wanted a hobby, so I taught myself trading. The people I found to listen to all told me market timing wasn't possible. They lied, or hadn't found the secret sauce...

Then, in October 2024, I woke up on a Sunday morning and was reminiscing about all the wonderful trips I had been on with friends. I decided that I missed doing that, so I thought I needed to run another event on something, so that I could go on holiday with my friends and maybe make new friends.

I wrote the idea down and sent it to my two friends Nicola and Paul (co-hosts on my weekly webcast). I expected them to tell me they didn't think it was a good idea. I was wrong, they both loved it, so we went for it...

Once again, I turned my hobby (something I didn't quite realise how good I was at doing) into teaching what I learnt in trading and how to use my mindset skills to maximise profits.

Four months later, we were all in Mexico...

My Dad was a very good teacher, and he taught me that it was the teacher's job to teach things in a way that made it easy for the students to achieve the results they wanted.

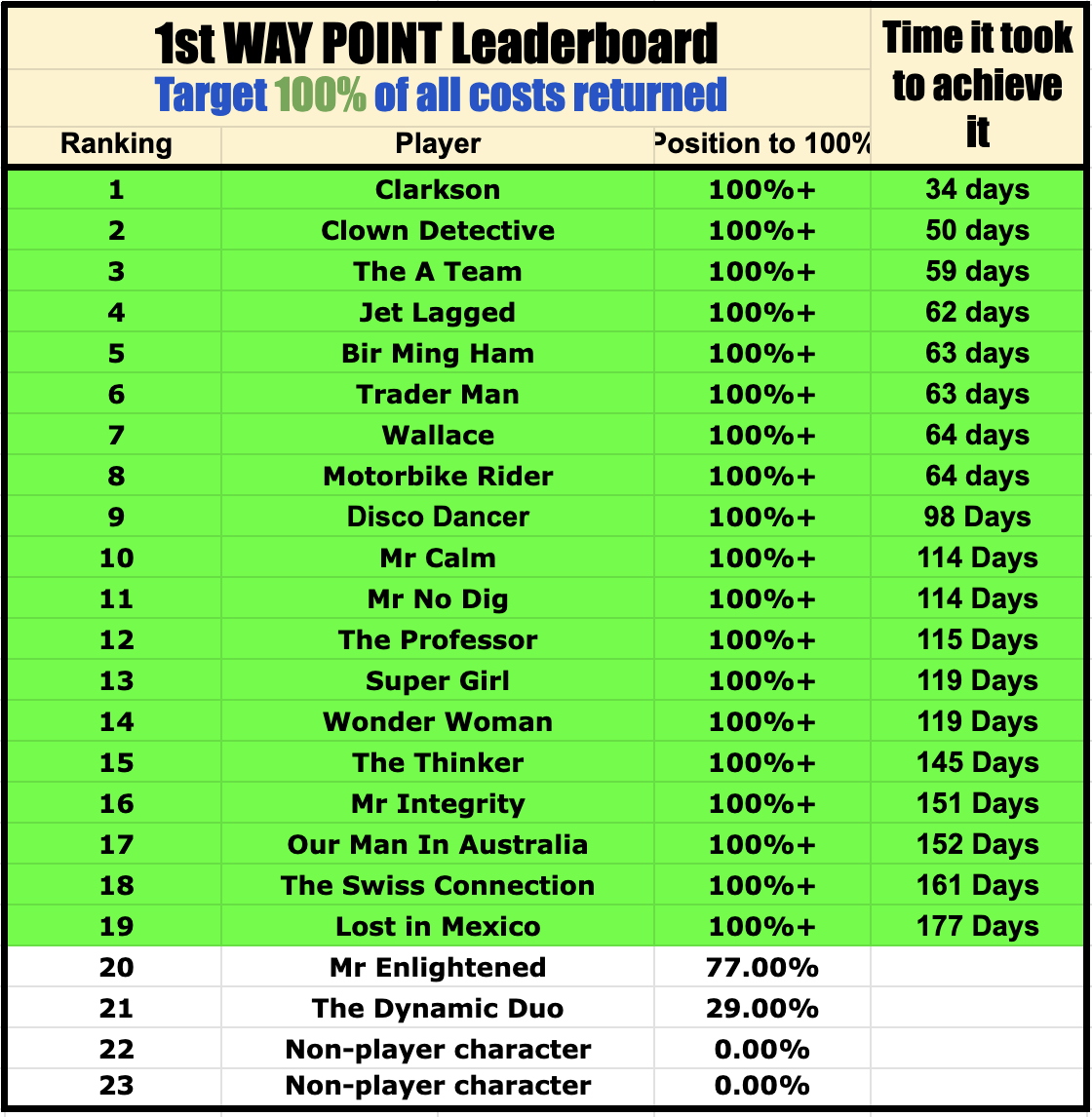

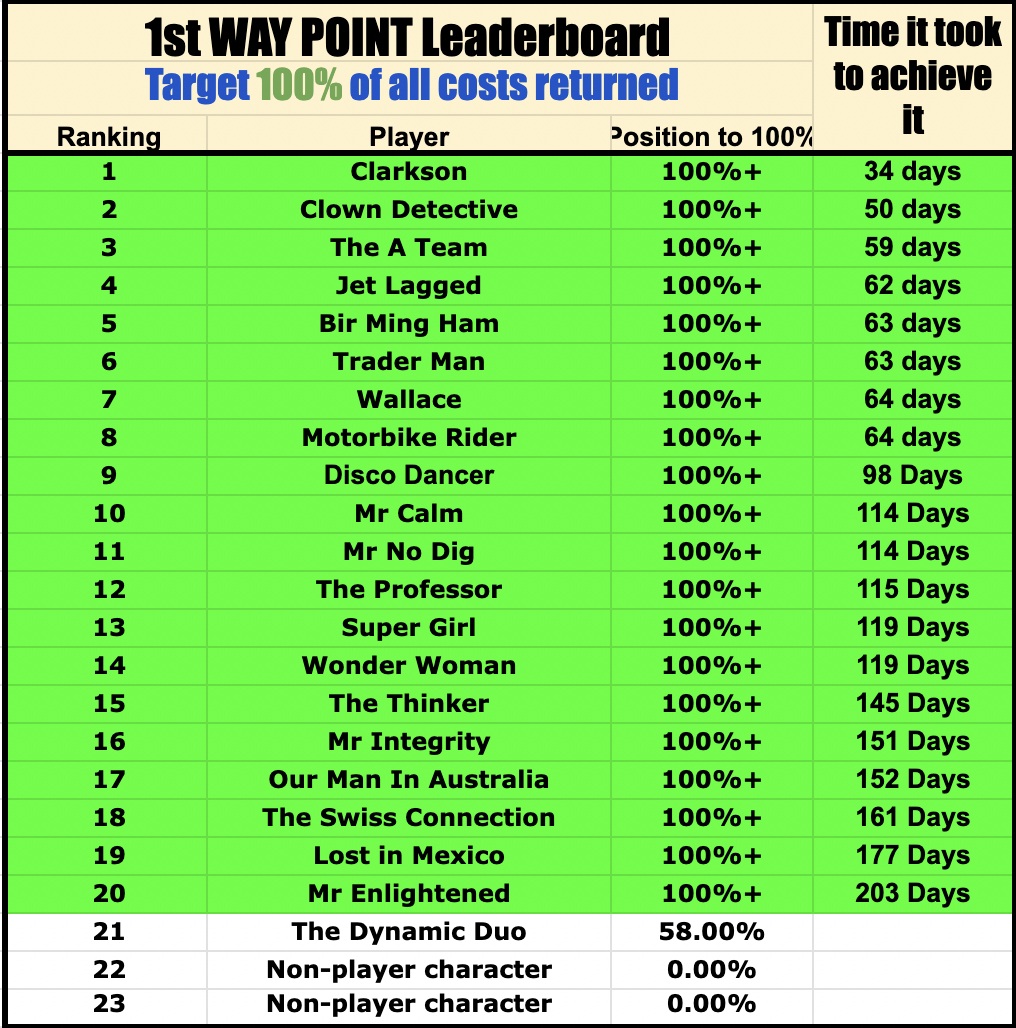

With a success rate of 82.6% of people who attended his first event in Mexico getting their costs to attend, and their travel costs back in an average of 101.26 days, I figure my Dad would be impressed.

So after that success, we decided to do another event in June in the UK, which again was a great success. But then we realised we all wanted to go on a few more exotic vacations together, so we have decided to run three events in 2026 and one in 2027 in Thailand, Greece, Costa Rica, with one yet to be decided.

I get to attend these events with my whole family and friends, and I do make new friends too, so I am living the dream, helping others financially and mentally, and I like to think I am inspiring others so that they can live to their dreams too.

This is me with my children, David & Sarah taken when we attended the last A Bug Free Mind Mastermind in Las Vegas in 2019

Do I have any proof this will work for you?

The image below shows that 82.6% of people who attended the first event recovered their cost to attend, and their travel costs back in an average of 101.26 days! All thanks to what they learnt, and what was shared with them subsequently in the weekly 'Chosen Ones'...

The date I added this image was Monday, 15th September.

I expect "The Dynamic Duo" to achieve 100%+ between the last week of September 2025 and the first week of October.

Turns out, one of the Duo had left it to the other one to do, and the other one felt a bit lost, so finally reached out, and I gave her some directions, which has put her back on the path to successfully achieving this first Way Point!

Which will mean... 100% of the students who engaged in this challenge will have gotten 100% of their costs to attend back. Which I think is pretty darn cool. I have never seen this achieved in ANY make money course ever before.

Currently, 50% of the people who attended the second event in Hampshire, UK, have already covered their full costs to attend back, and they have done so in less time than the Mexico attendees did.

Image taken on Day 6 of the Mexico Mastermind in Playa del Carmen

"Just out of interest, my 1st Way Point is 457% so maybe this isn't the scam I thought it was. Dare I say Mr Shaw may have been telling the truth with his original pre-Mexico marketing?" - 'Clarkson'

$39/Month $299/Year

***You will be added manually, can take up to 24 hours***

***This is a subscription and you can cancel at ANY time***

Here's A Lot More of What The People Who Attended The Mexico Mastermind Thought...

Mexico February 2025 Mastermind Attendee C.D. (NZ)

I attended Andy Shaw's Bullion Voyage Event in Mexico in February 2025.

I began placing trades on the 11th of February. By the 17th of March (ie. 34 days) I had recouped the total cost of my trip including course fees, accommodation and travel. Getting to the event involved 3 flights, including one of 15 hours so it's fair to say my costs were considerable.

My results were achieved by simply doing what Andy suggested. He gave us an amazing list of stocks to invest in which he had curated over several years. On top of that he even gave us a portfolio weighting for each stock ie. he told us what percentage of our investment funds to put in each company. Really simple stuff.

After investing my money in the stocks I simply watched. I added a few more stocks using what I had learnt at the event, but never sold any so the whole process was very easy.

I have been to a couple of Andy's events so I have complete trust in his ability to deliver what he says he will.

This time though I feel he has exceeded that significantly. I can honestly say this is the best money I have spent in my 58 years.

The ongoing support is outstanding and I would encourage anyone who is considering this to commit to attending the Bullion Voyage Event. To me it's been life changing.

Mexico February 2025 Mastermind Attendee J.F. (USA)

“Attending the Precious Metals Mastermind group was one of the top 5 choices that I have ever made in my life.

I would highly recommend to anyone seeking knowledge and wisdom in wealth building, trading, and financial knowledge to attend this life changing seminar.

Andy’s approach of disseminating his 5 years of intense study and research in this sector of the market, coupled with his unparalleled wisdom and ability to instill confidence in yourself through his proven Mindset techniques, is the magic bullet that will propel you to success beyond your imagination in many different aspects of your life.”

Mexico February 2025 Mastermind Attendee J.B. (UK)

"The main reason I came here with intention was for the mindset side because I’ve had A Bug Free Mind for years, and I’ve just, like I do with so many things, I dabble too much, I’m a terrible dabbler and I procrastinate — not a great combo. I just thought, when I do do it, it works so well, so why am I not consistent? And I thought if I come to this, it’ll be so inspiring that when I go home, I’ll have that impetus. So the key is I can’t let it lapse as soon as I get home — keep the momentum going. And I kinda thought it was gonna be like that, and I’m absolutely convinced it’s gonna be like that now. So that was it, when I realised that’s how it’s gonna be, that’s when I said — I think it was about the middle of the week — this could just be about the best money I’ve ever spent, and I haven’t changed my opinion, it’s just become more reinforced now."

Mexico February 2025 Mastermind Attendee Y.H. (CN)

"Because I read A Bug Free Mind, that’s why I’m here, so you could say that without that I would not be here. I know that we have a common background, but Andy has his own style. I feel comfortable, I appreciate what they have done in the last week. I have been very happy these days, all of us have been a good team. I want to express my appreciation for being here with you."

If you like the sound of attending a future Mastermind with us, Then Check Out Our 7-day Mexico Mastermind, After Movie >>>

If this sounds like something you'd like to have access to, subscribe today.

Get My Weekly Gold & Silver Timing Briefing — For Just $39/Month or $299/Year

***You will be added manually, can take up to 24 hours***

***This is a subscription and you can cancel at ANY time***

Disclaimer: I am a talented amateur at this, but I am also an idiot and often get things wrong and lose money. I may own or trade any of the names mentioned in this piece at any time, without warning. This is not a recommendation to buy or sell any stocks or securities—just my opinions. I frequently lose money on positions I trade or invest in. I may buy or sell any of the names mentioned in My End of the Week Market Thoughts at any time, without further notice. None of this is a solicitation to buy or sell securities. These positions can change immediately after I publish the list, with or without notice. You are responsible for your own decisions. Do not base any decisions on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided on this page. These are not the opinions of any of my employers, partners, or associates. I have done my best to be honest about my disclosures, but I can’t guarantee I am right—sometimes I write these posts after a couple of beers. Also, I just straight up get things wrong a lot. I mention this twice because it’s that important.

Copyright 2025 Bullion Voyage, all rights reserved.